During the early days of the mortgage business, brokers would require a lot of paperwork…

Fixed Mortgage Rates Keep Rising, and Could Continue as Bond Yields Near 4%

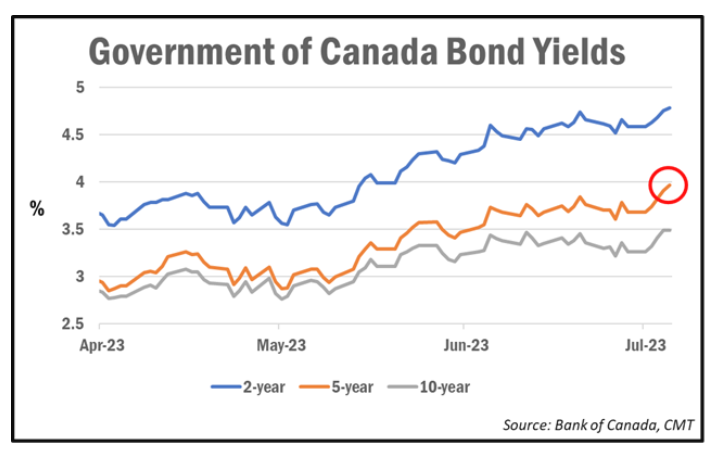

Fixed mortgage rates are continuing to increase, driven by rising bond yields. The yields reached a significant level of 4% after strong employment data was released in Canada and the U.S.

Although they later dipped slightly, bond yields have been steadily climbing for the past few months and saw a jump of almost 30 basis points in a single week.

As a result, mortgage providers have been raising their rates almost weekly, with 5-year fixed rates now ranging between 5% and 6%.

Shorter-term fixed rates, including 1- and 2-year terms, are also rising and currently sit in the 6% to 7% range. Even popular 3-year fixed terms are now approaching 6% after disappearing from the 5% range.

These rate increases mean that individuals seeking new mortgages now have to qualify based on a stress test rate of 8% or even 9%. This requirement is due to borrowers with either insured or uninsured mortgages having to qualify at a rate that is 200 basis points higher than their contract rate.

What happens if bond yields rise above 4%?

The possibility of bond yields surpassing the 4% mark has implications for fixed rates in the near future. If the 5-year Government of Canada (GoC) bond yield manages to break through the 4% threshold, it could lead to subsequent increases in fixed rates. Experts suggest that sustained closure above 4% may result in rates rising by around 40 basis points, potentially prompting lenders to raise rates frequently.

The current spread between bond yields and fixed rates offered by major banks is significant, currently around 250 basis points. This indicates a risk premium already factored into the rates. As a result, any future rate increases are expected to closely follow changes in bond yields.

The fixed vs. variable question

Given the anticipated additional rate hike by the Bank of Canada and the ongoing fixed rate increases, borrowers are faced with the decision of choosing between fixed or variable rates.

The choice depends on future rate expectations. Should inflation be controlled, allowing rate cuts by early 2024, a variable rate may be more advantageous? However, if inflation remains persistent and leads to higher peak rates and delayed rate cuts until late 2024, a 3-year fixed mortgage could result in lower interest costs.

Ultimately, borrowers must evaluate their expectations and circumstances to determine which option aligns best with their needs and risk tolerance. It is important to consider the Bank of Canada’s potential preference for a cautious approach and the view that rates may remain higher for a relatively long period. Consequently, a 3-year fixed-rate mortgage is often seen as a safer choice for those currently in the market.